While most automakers such as Ferrari, Ford and GM performed rather robustly, Tesla has fallen short, and it’s not the first time in months, casting some uncertainty over the electric vehicle market. The broader automotive industry encountered several challenges, including issues with production forecasts, dealership operations, and certain revenue sources.

Why are they not spending as much? Most probably, a majority of people have used up all the extra money provided by the government during the COVID-19 pandemic and are now tapping into their primary savings to maintain spending levels that surpass their regular earnings.

Though job market is currently going steady, inflation and high prices will still directly effect the automotive sales in the country.

KEYPOINTS:

- Prospects for EV sales seem foggy.

- Politics will pave the way for EV numbers.

- Consumers are still buying cars. Despite inflation, automotive demand remains robust.

- What to expect by end of 2024? More cars!

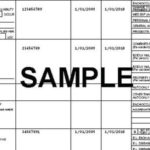

But good thing is, gasoline prices have been declining since october. Not only that, even raw materials price are decreasing. This will definitely boost car production. Question is, will car prices go down? Albeit, a little bit?

Due to this fluctuations, there are certain automotive patterns that could be on the horizon for 2024. Let’s dive in for a better insight on what to expect in these following months.

Inflation Schminflation, Vehicle Demand Remains High

As supply chains stabilized and central banks implemented tighter monetary policies, the inflation of input costs was somewhat controlled. It’s anticipated that reduced costs for raw materials and transportation will keep benefiting profit and loss statements, particularly for suppliers, although the issue of labor costs persists. The strike by the United Auto Workers (UAW) led to notable hikes in labor expenses. This trend might extend, as companies not affiliated with unions are expected to sustain competitive pay rates.

- Prices have remained nominally unchanged; in reality, they have significantly increased.

- Interest rates have made vehicles significantly more expensive for consumers.

- Following three years of unprecedentedly low delinquency rates, the auto finance sector has essentially reverted to its pre-pandemic state.

- While the swift increase in missed payments might cause alarm, it’s important to recognize that the market is still strong and credit indicators remain quite healthy.

- We anticipate potential challenges primarily in the used car market, as it is more exposed to lower credit consumers and subprime loans.

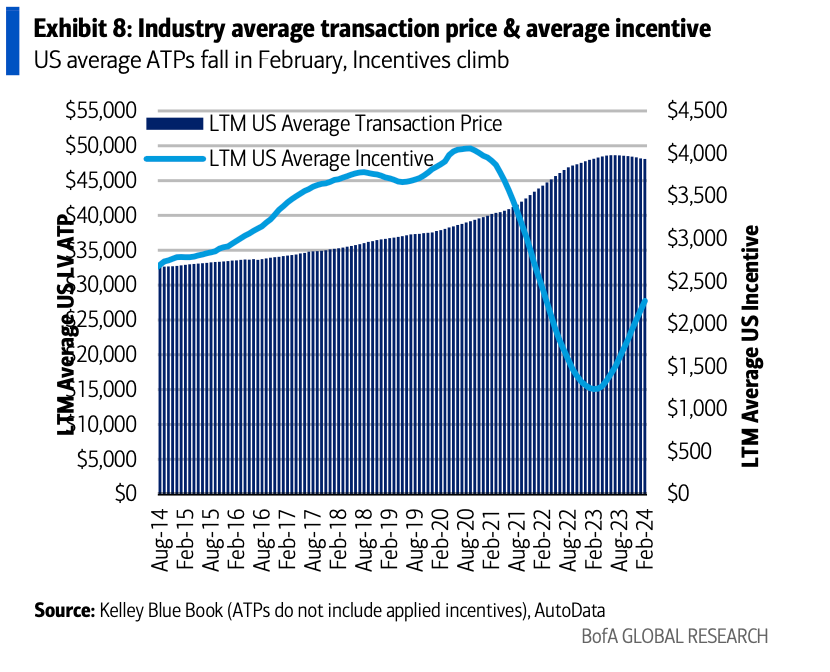

- The average price people paid for vehicles in February, according to Kelley Blue Book data, was $47,244, which is 2.2% lower than the prices last year at this time, meaning cars were a bit cheaper by about $1,072 per vehicle.

Even so, there is no notable dent in the automotive sales volume. Conclusion? Inflation ain’t got nothing on the US auto market. People are still spending money to buy a car and making ends meet. Most probably due to rising employment factors, and better wages, cars are still a necessity and having good demand.

The automotive market in North America is expected to maintain its growth trajectory, fueled by accumulated demand due to production limitations during the Covid era. The resurgence of fleet sales and the mass market’s rebound are poised to contribute to increased sales volumes, potentially impacting the product mix adversely.

- Average Transaction Prices (ATPs) may experience a slight decrease, attributed more to the shift in product mix rather than direct reductions in price.

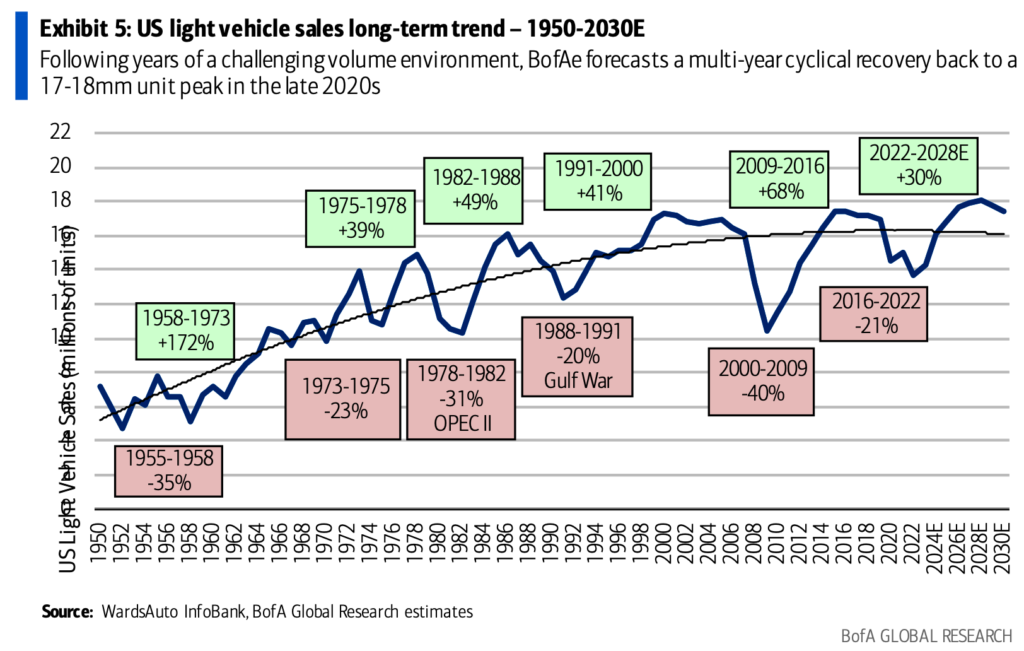

- Projections for the Seasonally Adjusted Annual Rate (SAAR) in the U.S. for 2024 and beyond remain stable at 16.1 million units, marking a 4% year-over-year increase, with anticipation of reaching the cycle’s zenith in 2028.

Expect more growth in US auto sales in 2024

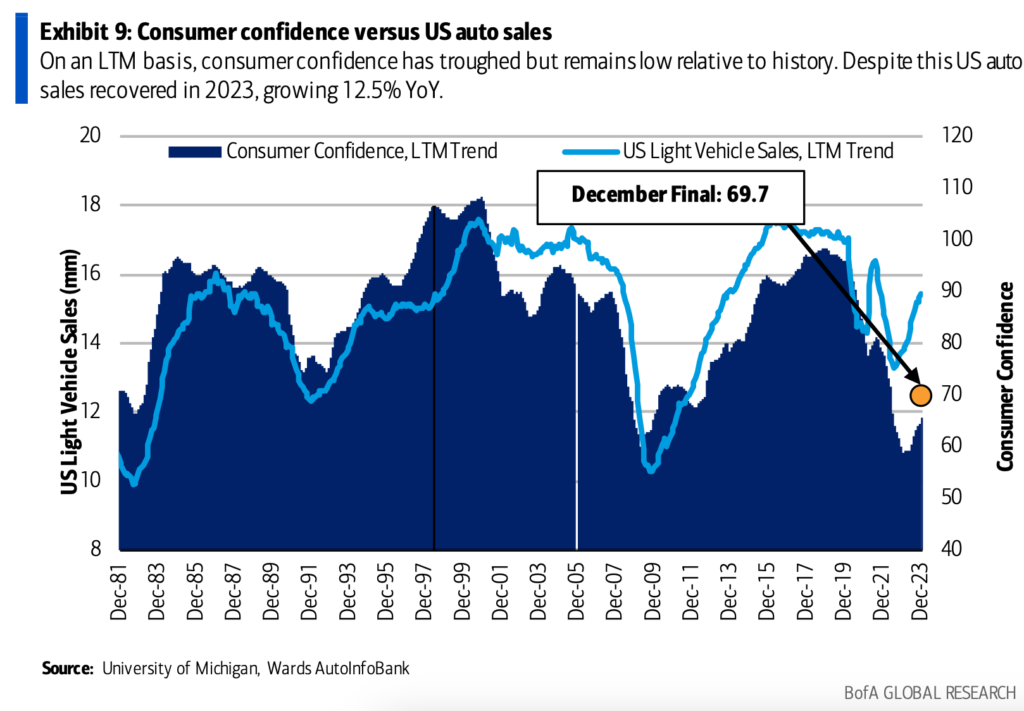

After a seemingly V-shaped recovery in the US automotive cycle through mid-2021, supply chain challenges served as a key impediment to US automotive sales and production throughout 2022, keeping the US seasonally adjusted annualized rate (SAAR) near recessionary levels.

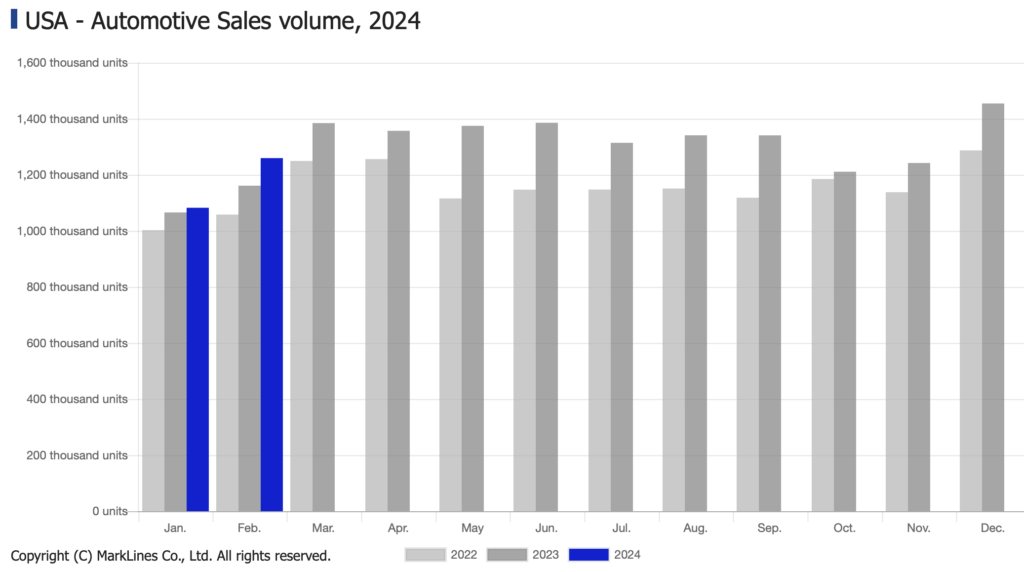

- At 13.8mm, the US SAAR was down 8% in 2022. However, in 2023, as supply chains unlocked and consumer economy remained steady, US sales meaningfully grew and closed the year at 15.5m, exceeding BofA’s original estimate of 14.3mm driven by strength in fleet sales.

- As we enter 2024, we continue to see pent-up demand from the COVID years that will sustain and expand total sales.

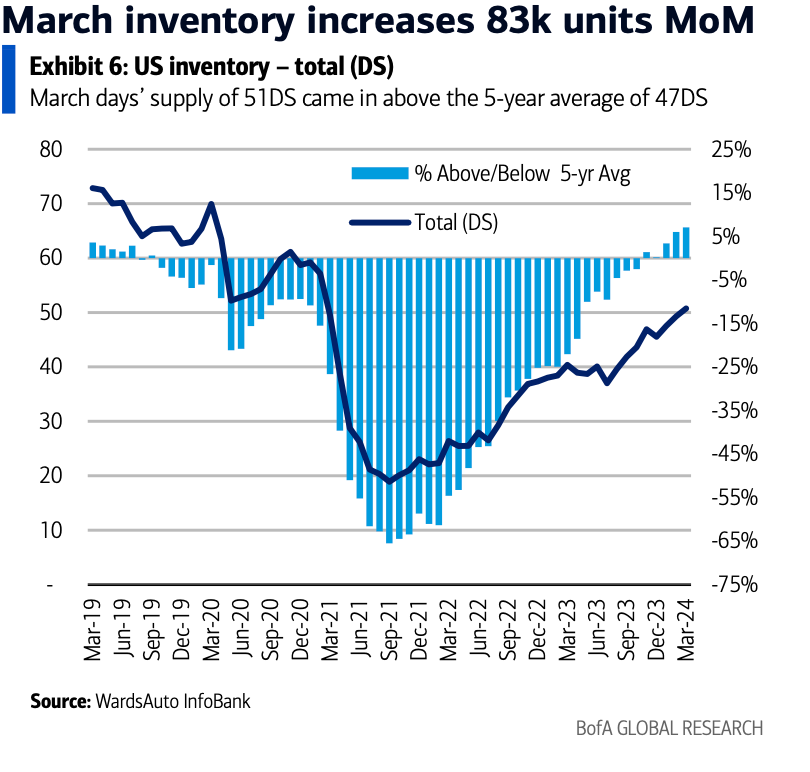

- With consumer confidence going strong, inventory is going to continue to increase, despite price pressure creeping in.

- Beyond 2024, inventories are expected to gradually increase on an absolute basis as sales increase, which indicates that OEMs will be able to remain somewhat disciplined with their inventory management.

Politics Causing Uncertainty

The 2024 US election cycle heralds significant implications for the automotive sector, given the divergent environmental stances of the Democratic and Republican parties. A Democratic win is anticipated to fast-track the shift towards clean vehicles, whereas a Republican victory might slow down this transition. While some policy positions, especially from the Democrats, are already in view, it’s still too soon to fully assess the potential impact on the industry.

- 2024 Elections have the potential to be extremely consequential for the Auto industry as the political parties have materially different views on the electrification of the industry.

- However, the rules and regulations governing electric vehicles are becoming increasingly uncertain in different regions, which is expected to slow down the pace at which electric vehicles are adopted.

- The Environmental Protection Agency (EPA), is a federal agency in the United States tasked with protecting human health and the environment. Although the EPA hasn’t made the switch to electric vehicles mandatory, it projects that EV sales will make up 67% of all US vehicle sales by the 2032 model year—a prediction that, according to expert analysis, is highly improbable.

- With all this uncertainty going on, it is highly unlikely that EV sales will soar higher than previous years.

However since the Inflation Reduction Act is in order, consumers will continue to seek alternatives to abide by the law and take the subsidies and tax exemptions to full advantage.

Additionally, automakers are offering bigger discounts and promotional deals (incentives) to encourage sales. These incentives were 90% higher than last year in February and slightly up from the previous month, amounting to an average of $2,828 per vehicle.

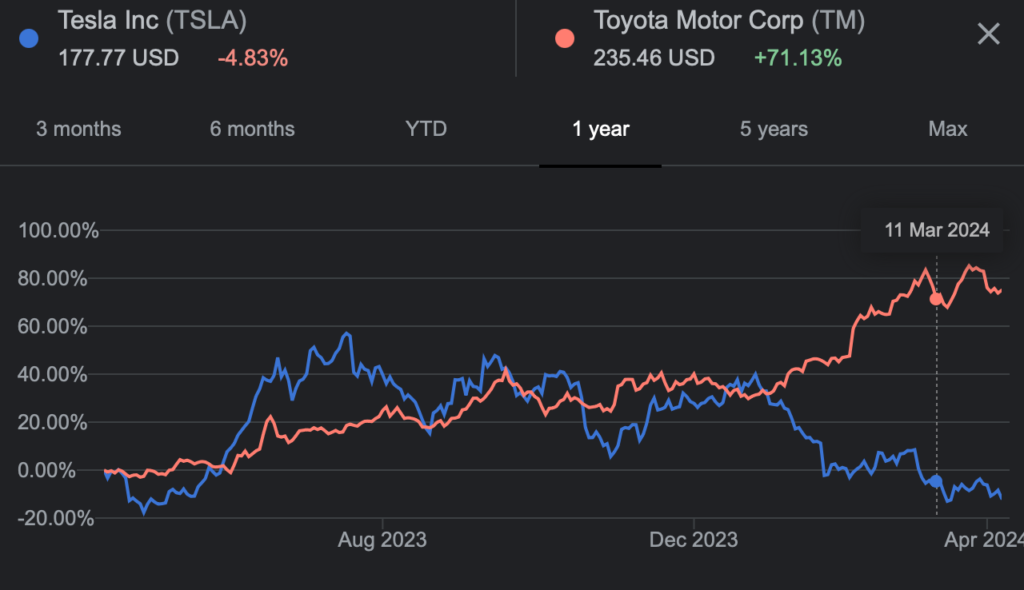

Outlook? That’s why we really think hybrids will take the trophy in bringing most sales by end of the year. Since EVs are too pricey and chargers are quite and issue, consumers will want another option, and hybrids will be the answer. Guess Toyota was right, after all. We’ll just have to wait and see how this plays along in the next few months.

Electrification Momentum at a Halt

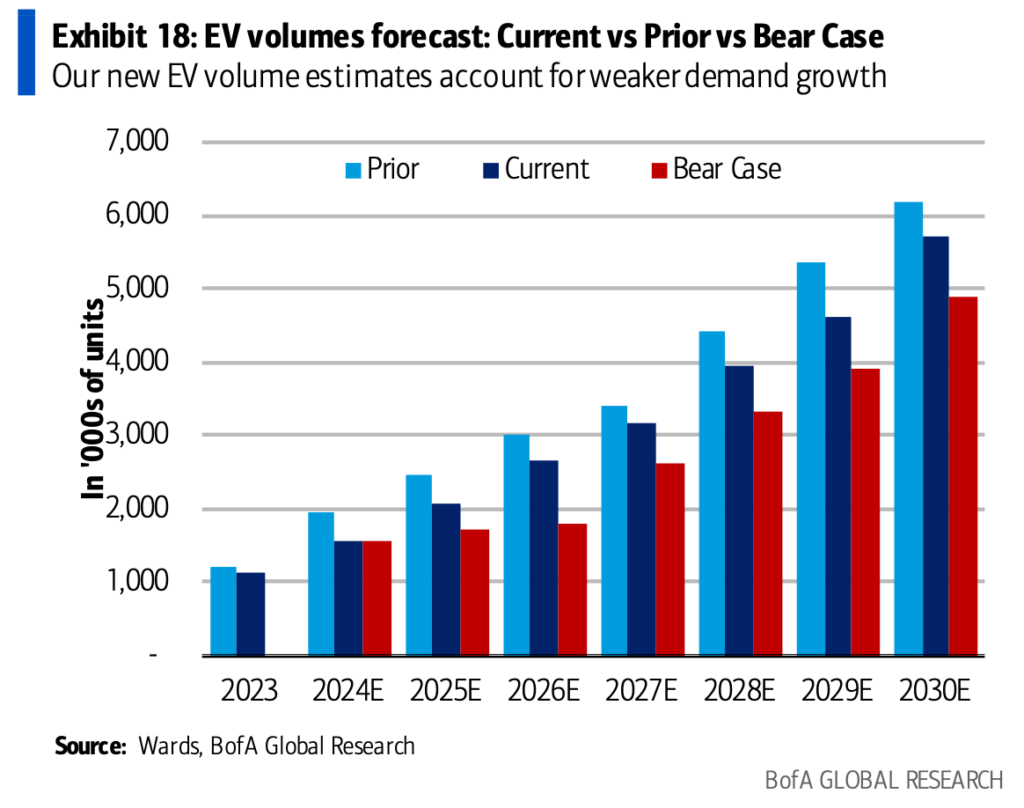

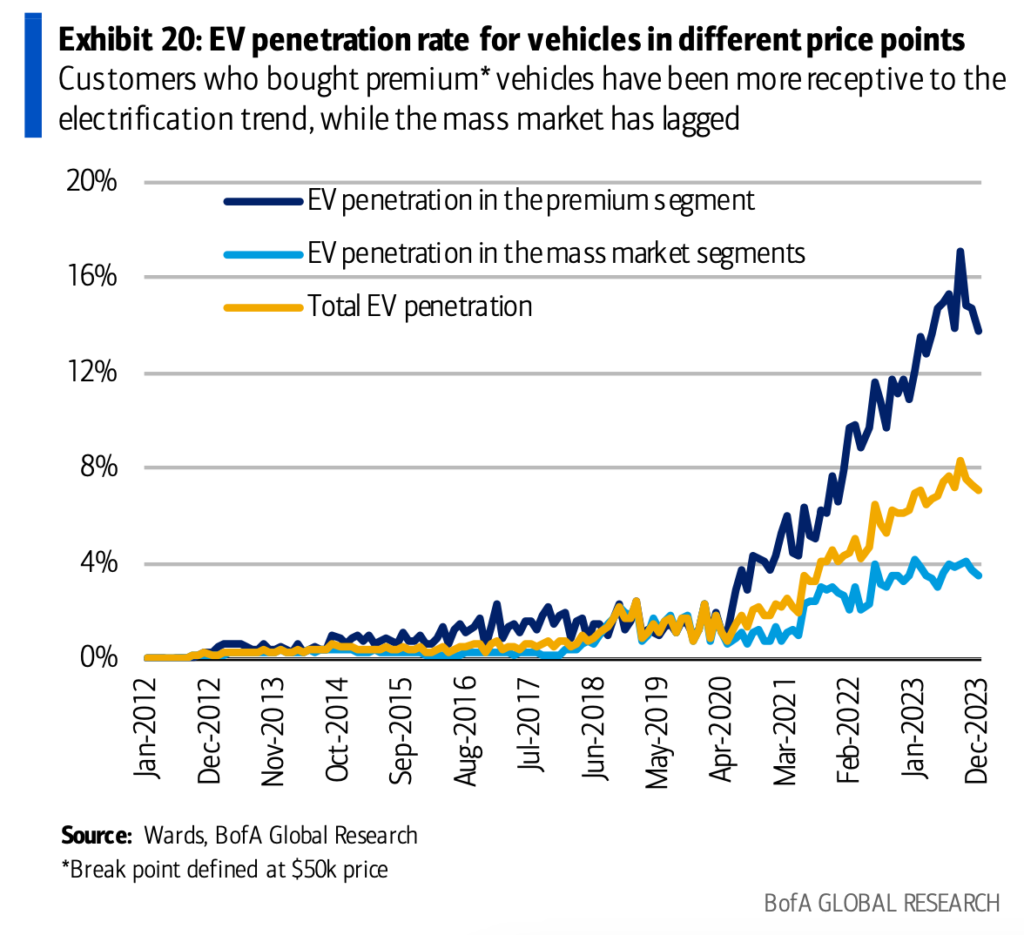

Now if we look at this closely, it could be clearly seen that Toyota is going strong compared to Tesla over the past few months. Toward the end of 2023, enthusiasm for EVs have waned. Observations from both dealers and OEMs aligned with a slowdown in EV sales. A closer examination reveals a split within the EV market: while the premium segment advances towards electrification, the adoption rate in the broader consumer market trails behind. This split appears to be primarily influenced by cost factors, with little expectation that EV prices will align with those of gasoline powered cars in the foreseeable future. As a result, the forecasts for EV adoption have been adjusted downwards.

- This delay can be linked to the higher prices of EVs, making them less accessible to the mass market, and hybrids acting as a bridge for mass market consumers towards electrification.

- The North American market’s characteristics present a challenge to EV affordability, influencing the slower adoption rates compared to other regions.

- It also looks like the parts inside an electric car, excluding the battery would cost about $34,100. This is more than last year because the prices for materials have gone up, even though companies are trying to make things cheaper.

- The high-end market is quickly shifting towards electric vehicles (EVs), whereas the broader consumer market is progressing more slowly, with hybrid vehicles emerging as a more practical transitional option.

- Since mid-2023, demand in EV sales in the US has slowed down, casting a net of doubt on how quickly the powertrain transition will happen.

- Therefore, a significantly positive contribution to EV penetration in the near-term is not expected.

- Majority growth in vehicle sales will originate from mass market vehicles, particularly those produced by Japanese and Korean manufacturers. As mentioned before, this increase in the mass market is expected to primarily consist of sales of traditional vehicles and also hybrids.

- Consequently, though a squeeze on the market share of EVs is predicted, an overall increase in EV sales by volume is still foreseen to take place.

2024 is shaping up to be a year of strategic recalibration for the automotive industry, as it adapts to evolving consumer preferences, economic conditions, and technological advancements. The industry is poised for continued growth, buoyed by pent-up demand post-COVID and a robust consumer economy. Yet, this optimism is tempered by challenges in inventory management and pricing pressures. Dealers and OEMs must navigate these dynamics carefully, balancing the need for profitability with the imperative to remain competitive and responsive to consumer needs.

The upcoming elections loom large over the industry, with potential policy shifts that could either accelerate or impede the transition to cleaner vehicles. Additionally, inflationary pressures and the Federal Reserve’s interest rate policies will play critical roles in shaping consumer financing options and overall automotive affordability.

We’re suspecting that with the increased incentives given and stricter emission laws for a cleaner environment, hybrids will be the new in thing moving forward, and for many months to come. Until EV is priced more competitively with much better charging options, car buyers will look for a much cheaper, and more convenient alternative.