How Do Auto Insurance Deductibles Work?

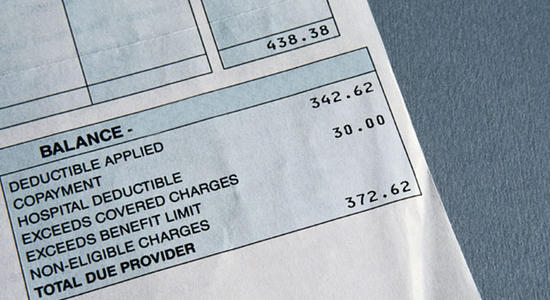

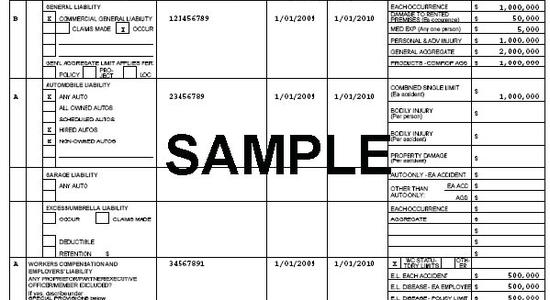

For those who are not familiar with the term auto insurance deductibles; deductibles refer to the amount of money you pay out of your wallet before your auto insurance coverage take into effect. Insurance companies require policy holders to pay a certain amount depending on their contract before the policy holder can take advantage of their insurance. By knowing the amount that you can comfortably pay when accidents happen, you will be able to determine the right car insurance for you. Defining a Deductible Payment … Read more