Last Updated on August 14, 2023 by Calvyn Ee

Key Points

- Car sales in April saw a positive uptick despite the Fed’s raising of interest rates and economic uncertainty

- The industry is improving, but a return to “normal” levels will look a lot different than what others might expect

- EV outlook remains positive, with a potential increase in market share in future

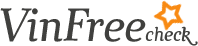

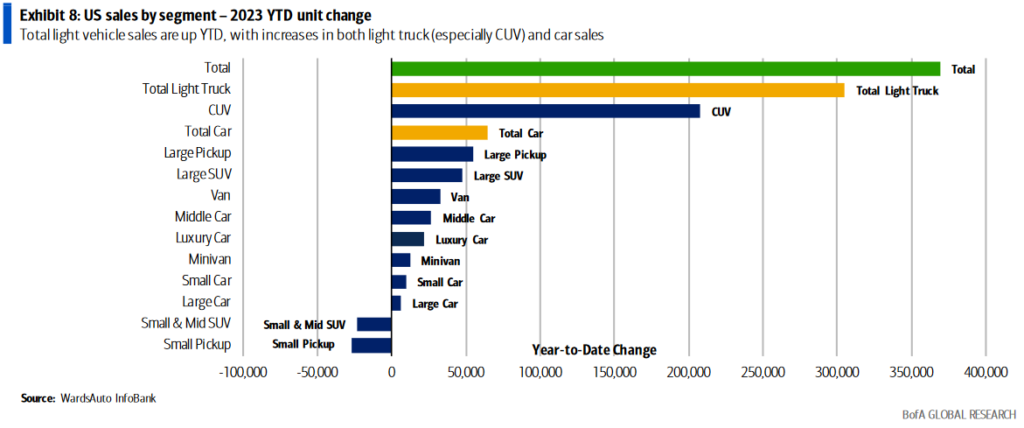

Continuing the positive trend from March, April saw an increase of 13.1 percent in light vehicle sales year-over-year, with a seasonally adjusted annual rate (SAAR) of 15.9mm. Car sales increased 15.3 percent year-over-year, while light trucks went up 12.6 percent a year. Despite all the hype surrounding hiking interest rates and fears of a recession later in the year, vehicle sales remained strong.

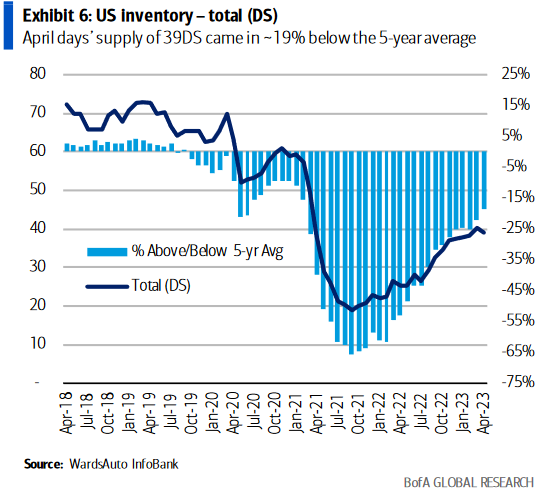

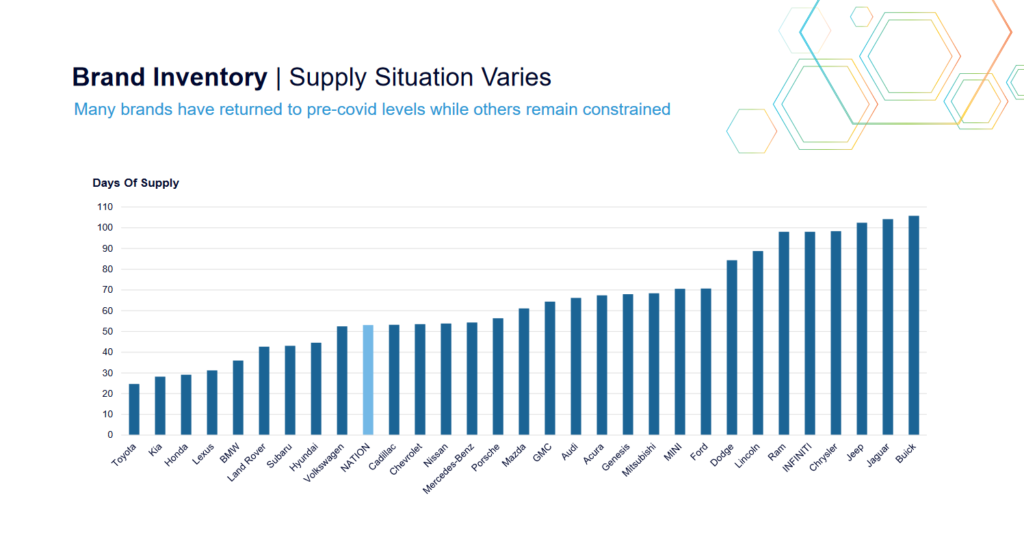

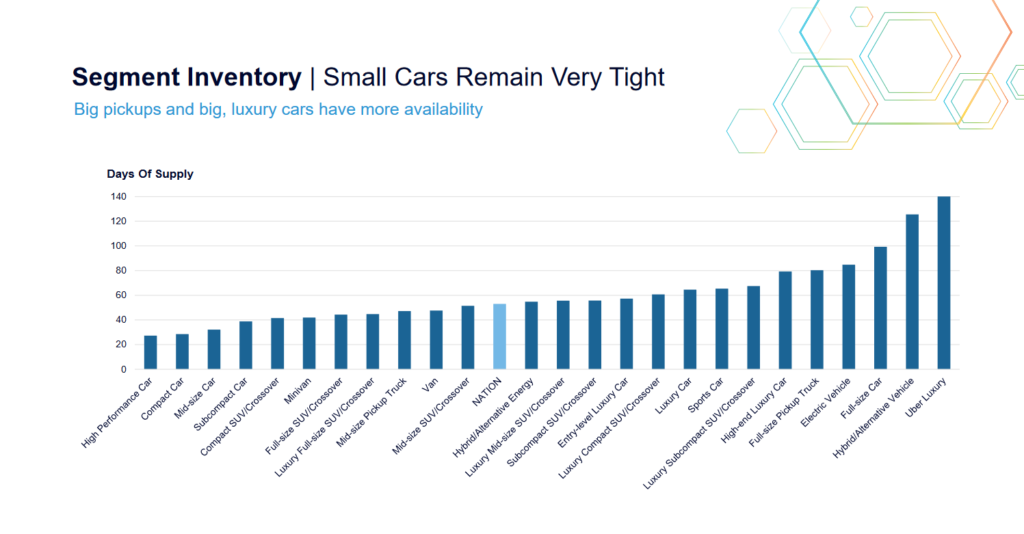

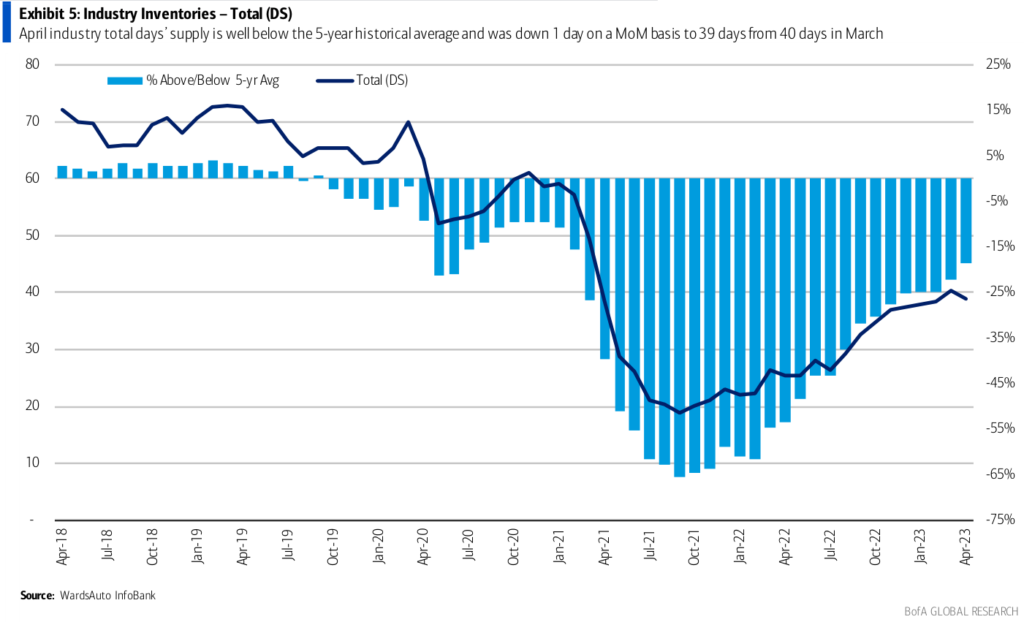

Much improved supply has helped to spur April’s substantial increase in vehicle sales, even though “total automotive inventory at the end of April 2023” went down by 46,000 units from the end of March 2023. Much like the last month, however, inventory levels are still below “normal” levels, but things are starting to normalize as was previously predicted.

However, inventory improvements have not been equal across the industry as Asian automakers such as Toyota, Honda, Kia, and Subaru continue to see constrained inventories, largely due to growing demand for these automakers’ vehicles.

Regarding auto segments, cars are now popular for more economical buyers, especially given higher gas prices and interest rates. As a result, they still remain on the tighter end of overall supply. The Honda Civic, in particular, is currently the lowest inventory of all other models owing to very strong sales.

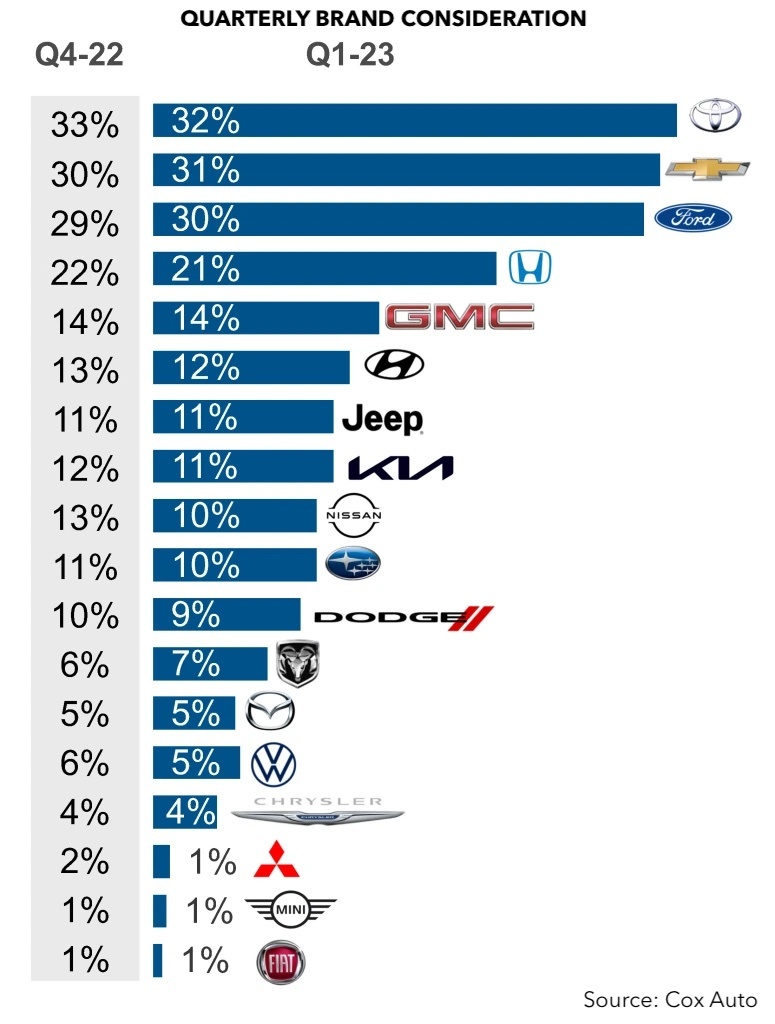

This comes in spite of the fact that shoppers more prominently considered luxury SUVs than cars, according to Kelley Blue Book’s Brand Watch report. Of course, this doesn’t necessarily equal increased sales, given the higher days supply of luxury vehicles.

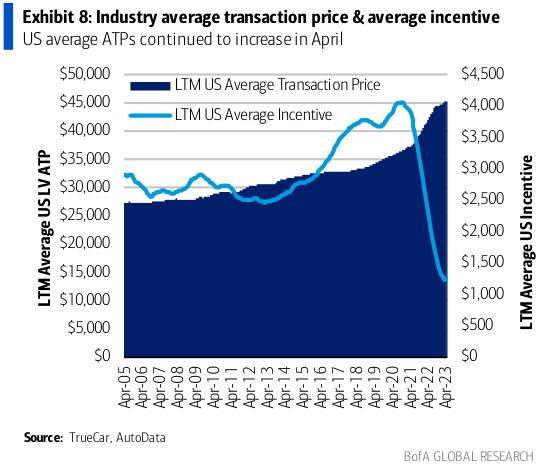

As a whole, average transaction prices (ATPs) went up 2.8 percent year-over-year to $45,251, based on TrueCar’s statistics. This equates to an increase of $1,233 per unit year-over-year. While new vehicle affordability and wholesale used vehicle prices saw some marginal improvements, automakers will still need to leverage various incentives, such as discounts, to stimulate sales for vehicle models with higher inventory levels.

Used car sales performance is looking a little under the weather despite minimal gains in sales and inventory. While sales in early April did improve compared to March, the pace is still down 4 percent from last year; on the other hand, total days of supply are down 13 percent compared to last year. Used car sales performance will likely continue to lag throughout the year.

How Did We Get Here?

The Bank of America’s Global Research arm predicts that current “depressed sales” will slowly drive consumer demand for vehicles as time passes, so much so that they expect “a relatively steep increase in auto sales” next year. Even so, the overall automotive outlook is still in flux, given that many industry players struggle to meet demand due to low inventory or other relevant issues.

The Covid-19 pandemic was a particularly important lesson for the automotive industry in how it significantly disrupted the entire industry in such a short span of time. Automakers who previously looked at lowering costs for higher profit margins were forced to seek more “resilient” options that could “withstand disruptions” to supply chains, production capacity, and more. Circumstances eventually improved in time, but different segments experienced this very differently.

While North American automakers quickly got back on track, Japanese automakers were facing regional challenges of their own, such as the previous year’s earthquake that hit Fukushima, which affected their supply chains. Similarly, Europe faced its own set of complications due to the Ukraine war. However, that’s not to say that North American automakers don’t have their own challenges.

While conditions are starting to (slowly) normalize, the question then becomes, “What constitutes normalization?” To Jonathan Smoke, Chief Economist at Cox Automotive, it doesn’t mean we’ll get back to “2019 levels” of car prices.

“There has never been a case that an increase in prices results in prices in the vehicle market going back to what they once were. Vehicle prices are very sticky, and it’s more that you have stepped changes in what occurs in the prices, especially in a world that is supply constrained.”

Jonathan Smoke, Chief Economist, Cox Automotive

It will take a great deal of time and effort to overcome existing challenges, including overall affordability before the industry gets a sense of what is normal in the future. All we know is that the “normal” of the present will obviously not be the same as the “normal” of the future.

A Mixed Consumer Outlook

Amidst all this, consumer buying power remains strong despite the “worrying” state of the economy. Real consumer spending saw a 3.7 percent increase quarter over quarter as average hourly incomes also increased 4.2 percent in March. On the other hand, however, both initial and continuing unemployment claims saw unexpected fluctuations even as the job market remained robust.

Moreover, despite a marginal improvement in auto loan performance in April, it still remains “much worse than a year ago.” Additionally, auto loan access has tightened substantially following the Federal Reserve’s decision to hike interest rates by a quarter point on May 3rd, the prospect of buying a new car is much more costly in the long term.

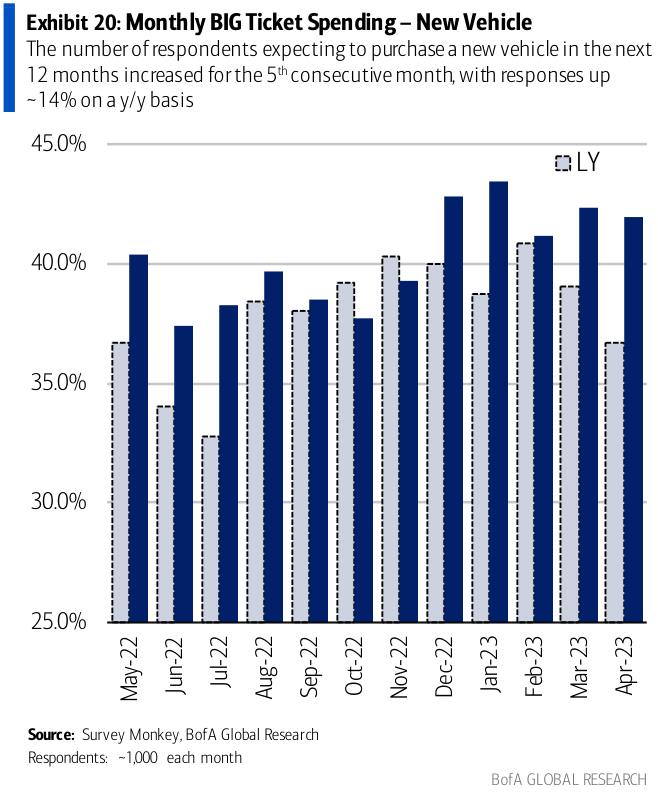

Even so, considering the substantial sales figures in April, it shows that prospective shoppers aren’t deterred from eventually purchasing a car of their own. Purchasing expectations are also still on an upward trend, with one survey noting more respondents were expecting to buy a new vehicle within the next 12 months (see below). This does support Kelley Blue Book’s aforementioned findings as well.

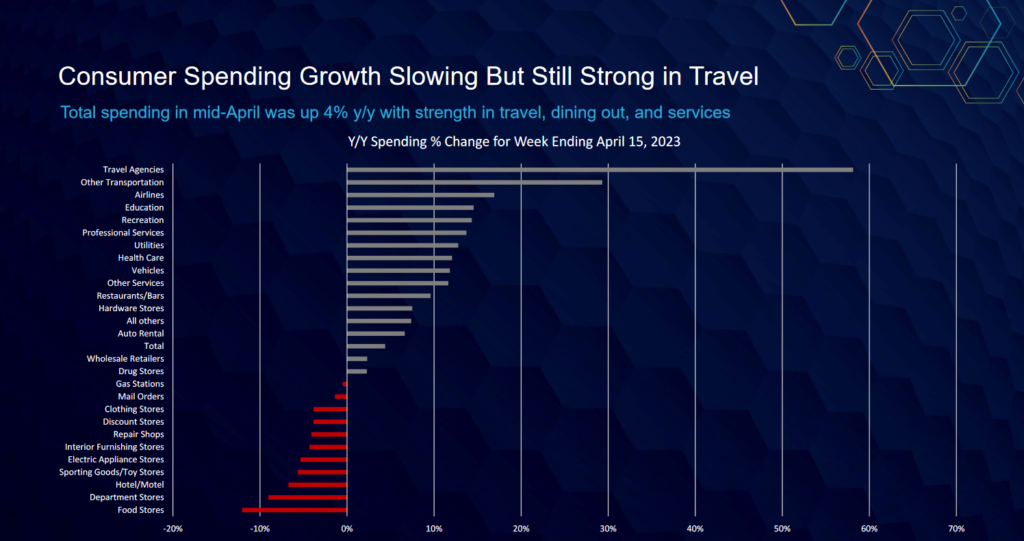

However, some signs indicate a gradual slowdown of consumer spending as early as mid-April, with credit card spending data indicating a 4 percent increase year-over-year. Adjusted for inflation, Cox Automotive notes that “spending is now down on a year-over-year basis.” Interestingly, consumer spending trends focused on travel, dining out, and services.

On that note, credit card debt has grown to $17.6 billion, “the highest growth rate in a year,” according to Cox Automotive.

The bottom line is that consumers are still in a relatively stable position in terms of finances, but that will eventually shrink as personal savings dwindle, companies cut on costs by retrenching employees and increasing prices, and fewer incentives are put into place to entice potential buyers.

EV Outlook Staying Strong

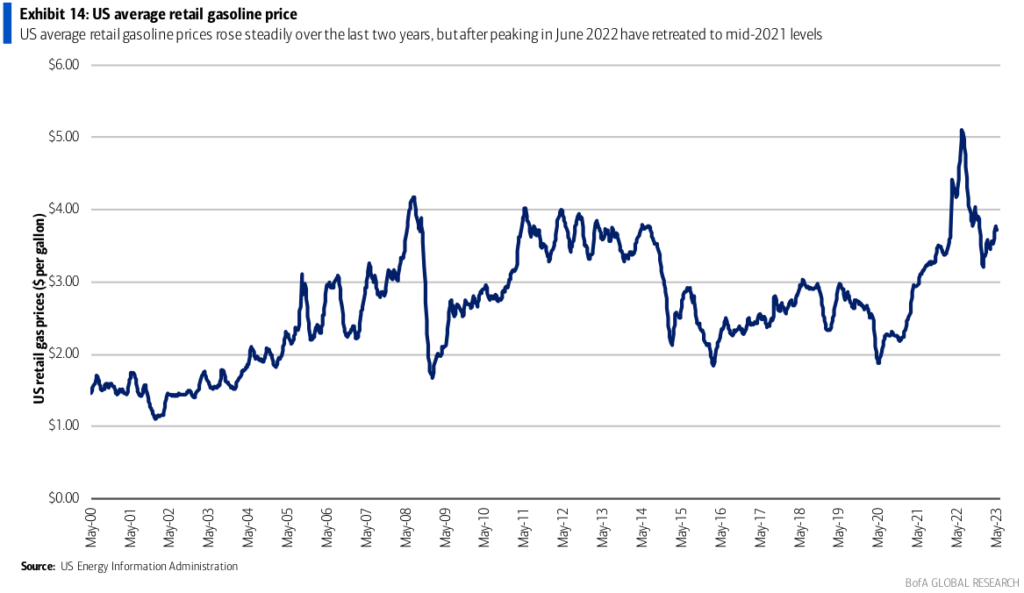

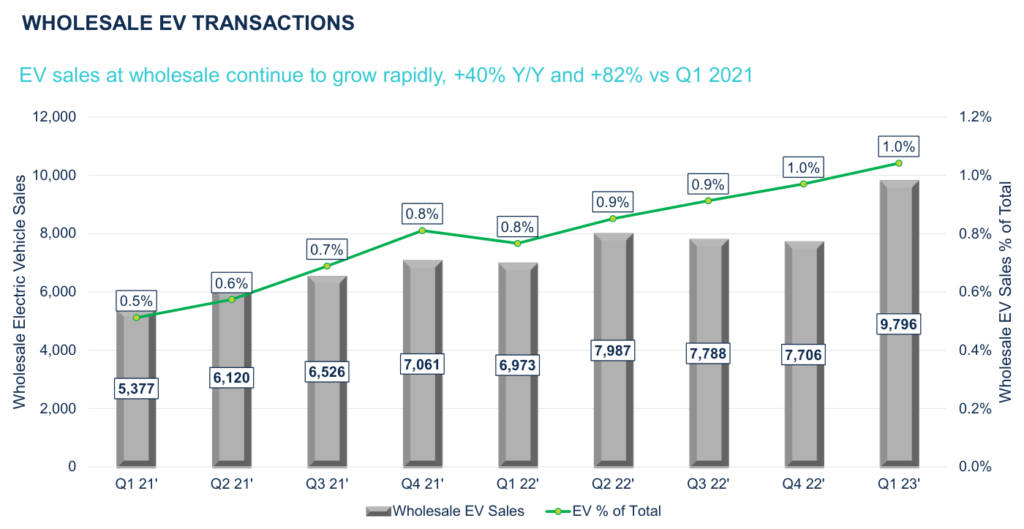

Sales of both hybrid and electric vehicles have seen modest increases as gas prices continue to fluctuate. EV sales, in particular, saw an impressive 40 percent year-over-year growth bolstered by gas price spikes in March.

Meanwhile, Experian reports the total number of battery electric vehicle (BEV, also known as all-electric cars) registrations in the first quarter of 2023 reached 257,507 – a 63 percent increase compared to the previous year.

Interest in hybrids and EVs is also growing: Kelley Blue Book found that 20 percent of shoppers are looking at new electrified vehicles, whether a BEV, hybrid, or alternative fuel vehicle. This trend has also influenced vehicle segments: for example, pickup truck shoppers may now be actively considering electric trucks and not only ICE ones, fueling that interest and demand for such vehicles.

While Tesla had previously led the charge regarding market share, non-Tesla BEVs now equated 40 percent of the market share this quarter, compared to last year’s 28 percent market share in the same period. Consumers are more than happy to consider something other than a Tesla, given the improving diversity of EVs between brands and models.

We still believe that the EV outlook will continue to stay on an upward trend despite talk of an impending recession later in the year. The notable growth in customer interest in electrified vehicles is promising, but a recession could shift customer priorities away from new vehicles to more important things like groceries. Once car prices reach new normals, we anticipate a steady rise in EV sales throughout the year and into 2024.